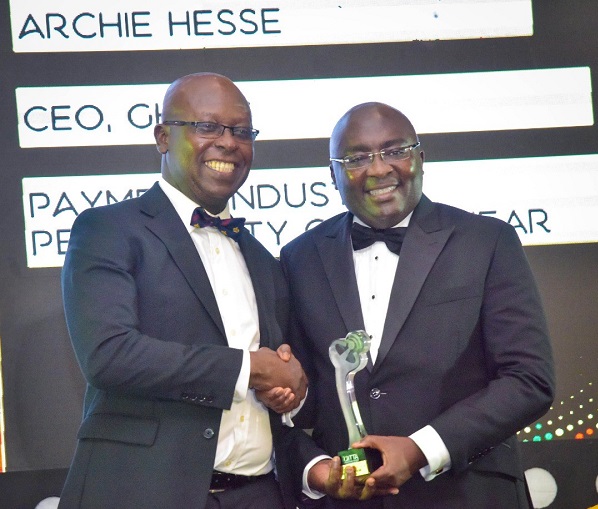

CEO of GhIPSS is Payment Industry Personality of the Year

The Chief Executive Officer of GhIPSS, Mr. Archie Hesse has been awarded the Payment Industry Personality of the Year at the 2019 Edition of the Ghana Information Technology & Telecoms (GITTA) Awards.

He was honoured for his contributions to the development of Ghana's payment systems; as well as for spearheading the development of the Mobile Money Interoperability platform after GhIPSS was commissioned by the Vice President, Dr. Mahamudu Bawumia to develop the MMI platform.

The Mobile Money Interoperability (MMI) platform has recorded more than 4.4 million transactions since it introduction in May, 2018. Beginning with just 96,907 transactions in May, 2018, public usage of the cross-network platform has grown phenomenally from 422,275 transactions in December last year to 502,873 transactions in May this year.

Archie Hesse, joined GhIPSS in 2007 as a General Manager in charge of Projects & Business Development. Whilst in that role, he spearheaded the implementation of a National Biometric Smart Card Banking and Payment System – e-zwich, the Cheque

Codeline Clearing (CCC) System, the Ghana Automated Clearing House (GACH) Systems for direct debit and direct credit, and the National Switching and Processing System – gh-link until his appointment as CEO in July 2012.

Under his leadership, GhIPSS introduced many reforms that have helped Ghana achieve “Universal Interoperability” with the completion of the mobile money interoperability Phase 1 & 2.

This achievement contributes to increasing electronic transactions in the Ghanaian economy, increasing efficiency in payments, and improving financial inclusion by bridging the gap between the banked and the unbanked.

About GITTA Awards

Now in its 9th year, the Ghana Information Technology & Telecom Awards is the most prestigious awards program in the industry. GITTA has become one of the industry’s most prized honors. It is an accolade given to individuals and teams. It is a vindication of the hard work, innovation and dedication of those at the forefront of this dynamic global profession.

Just a year after its launch, Mobile Money Interoperability—a system that makes mobile money transactions among different networks possible—has hit GH¢95.88million in value for the first quarter of 2019, the Payment Systems Statistics report published by the Ghana Interbank Payment and Settlement Systems (GhIPSS) has revealed.

Just a year after its launch, Mobile Money Interoperability—a system that makes mobile money transactions among different networks possible—has hit GH¢95.88million in value for the first quarter of 2019, the Payment Systems Statistics report published by the Ghana Interbank Payment and Settlement Systems (GhIPSS) has revealed.