Fintechs challenged to make online fee payment the norm – GhIPSS CEO

Many schools in Ghana require parents and students to pay their fees at various bank branches before, in some cases, continuing the process online. This is generally considered an improvement from the days when cash was paid at the accounts and cash offices of schools.

Many schools in Ghana require parents and students to pay their fees at various bank branches before, in some cases, continuing the process online. This is generally considered an improvement from the days when cash was paid at the accounts and cash offices of schools.

But the Chief Executive Officer of Ghana Interbank Payment and Settlement Systems (GhIPSS), Mr. Archie Hesse, said in an interview that the current system leaves much to be desired. He is of the view that parents and students should be able to pay their school fees electronically without visiting any bank branch.

Mr. Hesse is therefore challenging Fintech companies in the country to interface with the schools and their banks to provide opportunities for the public to pay school fees electronically; either using money from their bank accounts or mobile money wallet.

Ghana has made steady progress in its electronic payment infrastructure since 2007, introducing a number of electronic payment channels. Mr. Hesse argued that the current payment infrastructure creates opportunities for Fintech companies to device various solutions to address the public’s needs. He is particularly interested in seeing an end to the incidence of parents and students queuing-up at banking halls to pay school fees, when they can perform the same transaction from their mobile phones and computers.

The country has a burgeoning Fintech industry providing various technology-enabled financial solutions. In addition to the work being done, the GhIPSS CEO wants the Fintechs to address the school fees paying challenge as well.

He explained that payment remains a gap in the online admission processes of many schools. “A number of tertiary, secondary and even basic schools now allow their students to process admissions online; but the beauty of the great idea is defeated when payments must be physically made at bank branches. The Fintechs must get in there and close that gap.

Mr. Hesse said Ghana has some fantastic Fintech companies and hopes that some of them will develop and popularise suitable solutions, so that paying school fees electronically becomes the norm. He argued that once the school fees aspect is addressed, it will snowball to other everyday payments that are done manually.

He urged heads of educational institutions to engage the services of Fintechs, and together with their bankers find electronic payment solutions to address the challenge.

The GhIPSS CEO noted that electronic payment of fees, levies, taxes, fines and other such payments enhances transparency, provides an audit trail, reduces cost and provides better customer service. He explained that electronic payment is a great business proposition that not only save money for the institutions which use it, but should also be seen as a tool for better customer service.

Source: thebftonline.com

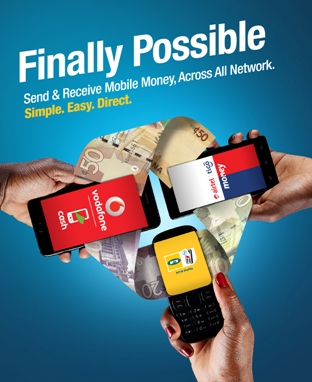

Cross network mobile money transactions continue to rise on a monthly basis after mobile money interoperability was introduced in May, this year, reaching almost 800,000 at the end of August.

Cross network mobile money transactions continue to rise on a monthly basis after mobile money interoperability was introduced in May, this year, reaching almost 800,000 at the end of August.