Quarterly highlights, performance insights, platform deep dive, and ecosystem updates.

CEOs Message

Dear Partners,

As we progress through the first quarter of 2026, I want to express my sincere appreciation for your partnership. The year-on-year growth recorded across our platforms is a testament to our industry’s collaboration and the deepening confidence in the shared systems we manage. The past year demonstrated the impact of our collective efforts. In 2025, the industry processed 530 million transactions, a 31.7% increase over the 402.5 million recorded in 2024. Even more significant was the growth in transaction value, which surged by 50%, from GHS 1.15 trillion to GHS 1.73 trillion.

These figures are more than just data points; they signal a shift in consumer behaviour and a validation of the "cash-lite" agenda. This success belongs to the banks, fintechs, and regulators who have worked in lockstep to make digital payments a cornerstone of Ghanaian commerce. Looking ahead, 2026 is an opportunity to build on this momentum. GhIPSS remains firm in its "infrastructure-first" mandate. Our role is to provide the secure, interoperable payment rails that strip away operational complexity, allowing you to focus on what you do best: innovating for the end user.

As digital transactions become more deeply embedded in daily life, the expectations for speed and security have never been higher. Our 2026–2029 Strategic Direction is designed specifically for this reality. We are committing the next four years to:

- Architectural Resilience: Upgrading our technology to meet international standards for scale.

- System Integrity: Enhancing fraud management and reliability to protect the ecosystem.

- Service Excellence: Ensuring our delivery supports your most ambitious digital payment goals.

In the coming months, I look forward to meeting with many of you during a series of courtesy visits to our partner institutions. These engagements will be vital as we align our efforts for the years ahead.

Together, we are not just processing transactions; we are advancing the economic fabric of Ghana. Thank you for being part of this journey. Do enjoy this edition of our newsletter.

Clara B. Arthur

Chief Executive

Industry Performance

In 2025, GhIPSS processed 530 million transactions, representing a 31.7% increase over the 402.5 million transactions recorded in 2024. Total transaction value reached GHS 1.73 trillion, marking a 50% year-on-year growth from GHS 1.15 trillion.The scale and pace of growth in 2025 reflect three structural shifts in Ghana’s payment ecosystem: Increased reliance on real-time and interoperable payment rails,Growing consumer confidence in digital channels, Continued transition from paper-based instruments toward electronic payments.

Transaction value growth outpaced volume growth, indicating increasing trust in digital channels for higher-value transactions and deeper integration of digital payments into business and commercial flows.

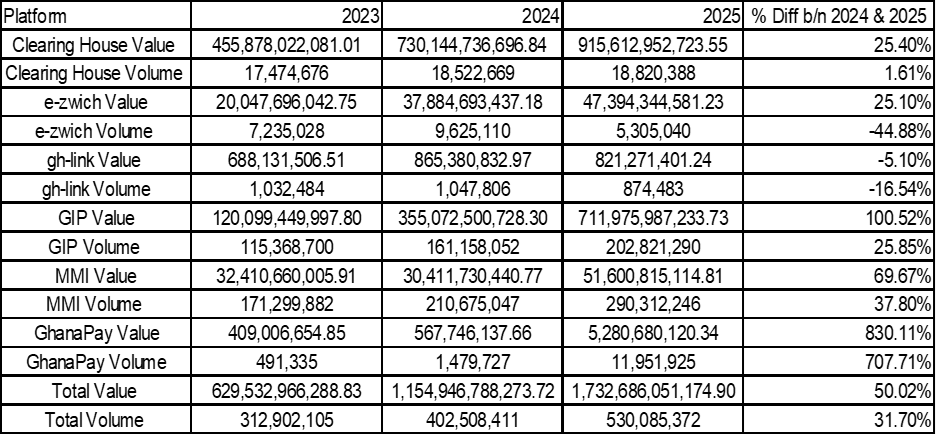

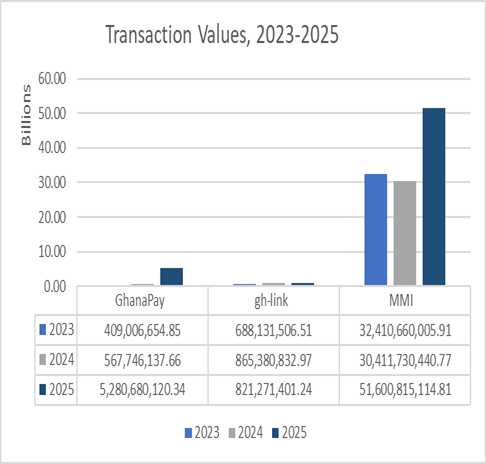

Below is a summary of the comparative Platform Performance, 2023 - 2025

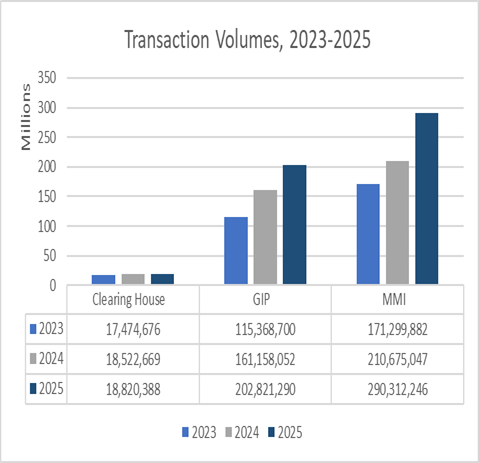

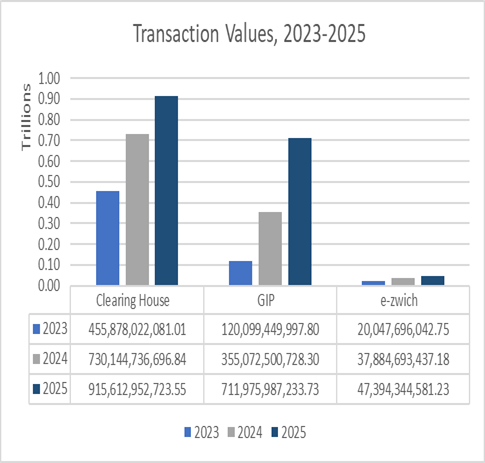

Clearing House ended 2025 with an increase in both transaction value and volume, with 18.82 million transactions processed, representing a 1.6% increase from 18.52 million in 2024. The value of transactions increased by 25.4% from GhS 730.14 billion to GhS 915.61 billion. Near Real Time (NRT) recorded a transaction volume increase of 43.27% from 2.24 million transactions in 2024 to 3.21 million transactions in 2025. NRT transactions values also grew within the reference period, from GhS 220.73 billion to GhS 357.70 billion, at a growth rate of 62.05%. This demonstrates continued sentiment towards speed and convenience for bulk payments. Cheque volumes declined by 5.26%, highlighting a gradual shift away from paper-based financial instruments. In contrast, cheque values increased by 10% in 2025, which might indicate that while volumes are declining, cheques are still preferred for higher value transactions.

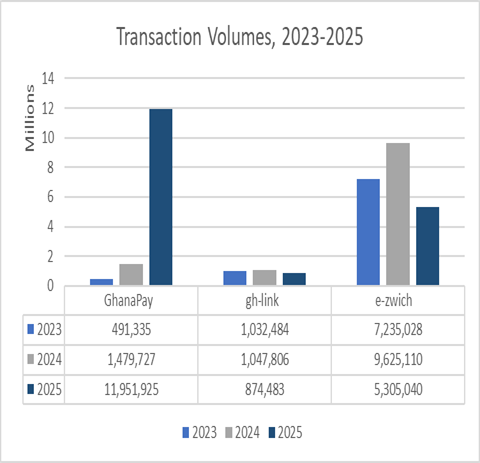

e-zwich also recorded some decline in the period under review. A total of 5.31 million e-zwich transactions were processed in 2025; this is a 44.88% decline compared to the 9.63 million transactions processed in 2025. The low volume is as a result of the absence of payments from key government schemes such as the National Service Scheme (NSS). Transaction values increased by 25.10% from GhS 37.88 billion to GhS 47.39 billion in 2025. At the end of 2025, e-zwich had 2.89 million cards with value, signifying its importance as it continues to play a vital role for government schemes and rural banking services.

The interbank switching and processing system, gh-link recorded a decline in 2025 in both transaction volume and value. Transaction volumes decreased by 16.54% from 1.05 million transactions in 2024 to 875 thousand transactions in 2025. Transaction values also declined by 5.10%, from GhS 865.38 million to GhS 821.27 million. Although ATM transactions continue to decrease, POS transactions show a steady uptick, increasing by 77.30% in volume from 29.21 million transactions in 2024 to 104.07 million transactions in 2025. This trend is driven by increased merchant adoption and promotional activities at retail outlets such as Melcom and China Mall through the year.

Notably, the GIP platform recorded growth in 2025, with transaction volumes increasing by 25.85%, from 161.16 million transactions in 2024 to 202.82 million transactions in 2025. Transaction values showed growth in 2025, from GhS 355.07 billion in transactions processed in 2024 to GhS 711.96 billion in 2025, a growth rate of 100.52%. GhQR recorded growth during the period under review, with transaction volumes increasing by 3.48%, from 839 thousand transactions to 869 thousand transactions. Transaction values also grew by 80.56%, from GhS 7.16 billion to GhS 12.92 billion. The platform added 167 thousand new agents in 2025, bringing the total count of agents on the platform to 576 thousand. The growth realized by the platform is an indication of customer adoption of QR code payments in Ghana.

Mobile Money Interoperability (MMI) transaction volume increased by 37.80% from 210.68 million transactions to 290.31 million transactions. Transaction values grew by 69.67% from GhS 30.41 billion to GhS 51.60 billion. Transaction value outpaced transaction volume growth in 2025 due to the removal of the electronic levy(e-levy), which encouraged customers to conduct higher valued transactions on the platform without the burden of the levy. Wallet-to-Wallet transactions remain the dominant service on MMI, accounting for 282.95 million transactions valued at GhS 39.71 billion.

The Transaction volumes on GhanaPay Mobile Money platform increased from 1.48 million in 2024 to 11.95 million in 2025, while transaction value increased from GhS 567.75 million to GhS 5.28 billion in 2025. The Platform enrolled 635 thousand new clients, bringing the total number of clients enrolled to 1.45 million. The agent network also expanded to 15 thousand agents in 2025.

The 2025 performance demonstrates GhIPSS’s efforts to driving Ghana’s cashless agenda and promoting a digital economy. Looking ahead to 2026, GhIPSS will continue to focus on enhancing customer experience, ensuring system reliability and stability, and working with stakeholders to deepen adoption and usage, and promote financial inclusion across Ghana.

Source: Kareen Nelson(MIS)

Platform Spotlight Deep Dive

Bulk Payments made easy with GIP Payment Distribution Module (PDM)

What is the GIP PDM?

The Payment Distribution Module (PDM) is a comprehensive bulk payment solution that enables Financial Institutions and Corporate Organisations to transfer funds to multiple recipients efficiently through one integrated platform.It supports payments such as:

- Insurance claim settlements

- Employee payroll

- Promotional payments

- Supplier payments

- Project fund disbursements

- Dividend payments

- Loan disbursements

Key Service Features

- Processing Portal

- One-to-Many Disbursements

- Maker-Checker Controls

- Account Validation (Payee Confirmation)

Benefits to Partners

- Streamline bulk payments to bank accounts and mobile money wallets, significantly reducing manual effort and processing time.

- It eliminates the need for multiple integrations with various beneficiary institutions,cutting administrative and operational costs.

- Beneficiaries are credited instantly ensuring that recipients can access and use funds immediately.

- This platform extends payments to unbanked and underbanked individuals who rely on mobile money wallets as their primary financial account.

- There is access to detailed transaction records and reporting tools that simplify reconciliation, auditing, and compliance processes.

How to Access the GIP PDM

For Financial Institutions

- Contact the GhIPSS RealTime Payments Unit.

- Complete the onboarding and integration requirements.

- Configure internal workflows (maker-checker, approval levels).

- Begin processing bulk disbursements through the PDM portal or via system integration.

For Corporate Institutions

- Engage your relationship bank and request access to the GIP PDM service.

- Complete onboarding documentation and compliance requirements.

- Receive portal credentials or API access (depending on deployment model).

- Start uploading bulk payment files for instant disbursement.

Our team provides technical guidance and support throughout the onboarding process to ensure seamless deployment.

Get Started Today

Contact the RealTime Payments Unit via:

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: 0501307312 | 0205398172

Transform your bulk payments today

Blog Post

Trust, Intelligence, and Infrastructure: The New Foundations of Modern Payments

Key trends and opportunities for promoting Financial Inclusivity

Ecosystem Collaboration Highlights

MoMo From MTN H.pays a courtesy call on GhIPSS

Delegation from the Ghana Association of Banks (GAB) visits GhIPSS

GhIPSS hosts a delegation from the UNCDF and the Bank of Sierra Leone

GhIPSS Hosts Annual Clearing House Association Meeting with Partner Banks

The Ghana Interbank Payment and Settlement Systems (GhIPSS) hosted the Annual National Clearing House Association (NCHA) Meeting on Wednesday,17th December,2025, bringing together members from all partner banks for discussions on the operations and future direction of Ghana’s clearing system. The meeting provided a strategic platform for stakeholders to review the performance of clearing house products, discuss operational efficiencies and align on initiatives aimed at enhancing service delivery in the upcoming year. Read more…

Industry Insights Section

Ghana’s Instant Payment System- GhIPSS Instant Pay, features in the SIIPS 2025 Report

SIIPS 2025 explores the latest shifts in instant payment systems across Africa. The report highlights key trends, challenges, and opportunities to shape digital payments, with a focus on inclusion and the role of IPS in advancing digital public infrastructure (DPI). Ghana’s progressed maturity stage is also highlighted in the report. Click link to read report: https://www.africanenda.org/en/siips2025

Top Banking Trend for 2026

For generations, technology, structure and risk appetite constrained what banks could achieve. Today, those boundaries are dissolving. Generative AI (gen AI), digital assets and the potential for new business models are rewriting the rules, creating possibilities that were unimaginable just a few years ago.

Click below to read the full Accenture Report on https://www.accenture.com/us-en/insights/banking/accenture-banking-trends-2026

World Payments Report 2026

As non-cash transactions grow, the global payments landscape is being transformed. The volume of non-cash transactions has increased more than tenfold in less than 20 years – marking a clear move away from cash toward digital payment methods. This strong momentum is both global and relentless, with non-cash transaction growth accelerating in every major region of the globe. Click link to read the 2026 Global Payments report: https://www.capgemini.com/insights/research-library/world-payments-report/

Infrastructure Update

ISO 20022: Why It Matters for the Industry

ISO 20022 is the global messaging standard for financial transactions. It provides a common language and structured data format that improves how payment information is transmitted, interpreted, and processed across financial institutions.

For Ghana’s payment ecosystem, alignment with ISO 20022 represents an important step in modernising our payment infrastructure. The standard enhances data richness, improves straight-through processing, strengthens fraud monitoring, and reduces reconciliation complexity. It also supports compatibility with international systems, positioning the ecosystem for smoother cross-border transactions and regional integration.

As part of our infrastructure modernisation agenda, GhIPSS will be advancing the integration of ISO 20022 across our core payment rails. This transition will require close collaboration across the industry to ensure seamless implementation and alignment. We will continue to engage our partners as we embark on this process to ensure readiness, efficiency, and shared success.