Industry Performance

In 2025, GhIPSS processed 530 million transactions, representing a 31.7% increase over the 402.5 million transactions recorded in 2024. Total transaction value reached GHS 1.73 trillion, marking a 50% year-on-year growth from GHS 1.15 trillion. The scale and pace of growth in 2025 reflect three structural shifts in Ghana’s payment ecosystem: Increased reliance on real-time and interoperable payment rails,Growing consumer confidence in digital channels, Continued transition from paper-based instruments toward electronic payments.

Transaction value growth outpaced volume growth, indicating increasing trust in digital channels for higher-value transactions and deeper integration of digital payments into business and commercial flows.

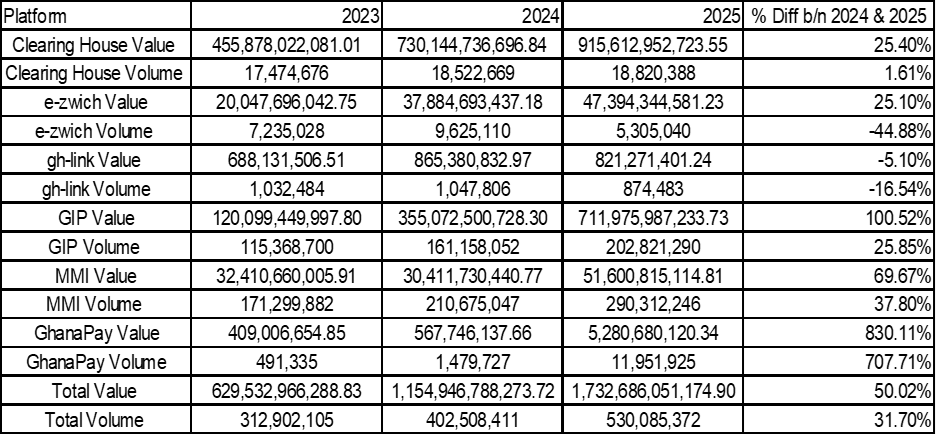

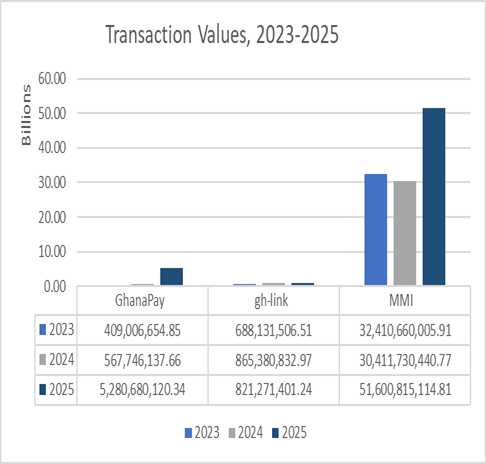

Below is a summary of the comparative Platform Performance, 2023 - 2025

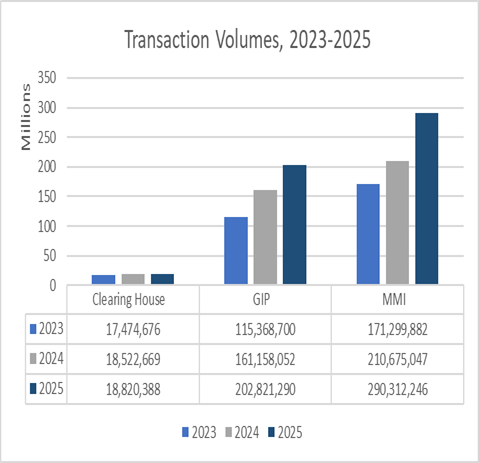

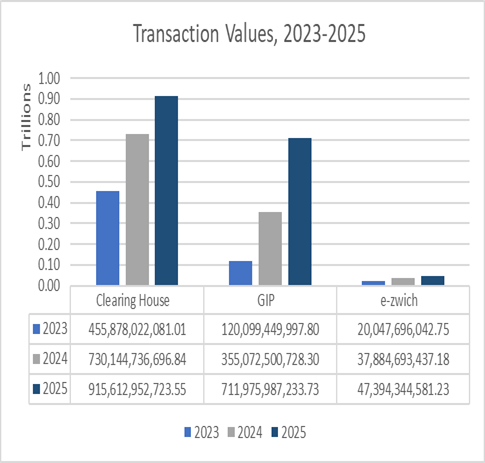

Clearing House ended 2025 with an increase in both transaction value and volume, with 18.82 million transactions processed, representing a 1.6% increase from 18.52 million in 2024. The value of transactions increased by 25.4% from GhS 730.14 billion to GhS 915.61 billion. Near Real Time (NRT) recorded a transaction volume increase of 43.27% from 2.24 million transactions in 2024 to 3.21 million transactions in 2025. NRT transactions values also grew within the reference period, from GhS 220.73 billion to GhS 357.70 billion, at a growth rate of 62.05%. This demonstrates continued sentiment towards speed and convenience for bulk payments. Cheque volumes declined by 5.26%, highlighting a gradual shift away from paper-based financial instruments. In contrast, cheque values increased by 10% in 2025, which might indicate that while volumes are declining, cheques are still preferred for higher value transactions.

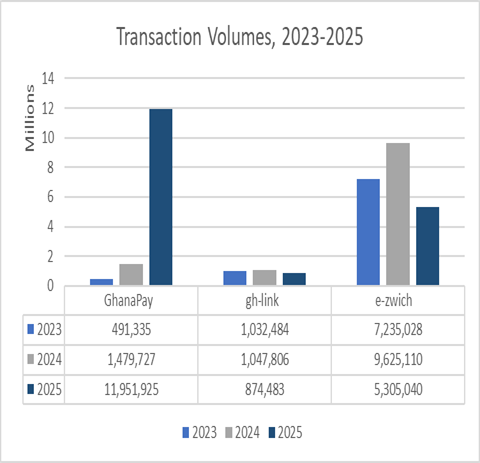

e-zwich also recorded some decline in the period under review. A total of 5.31 million e-zwich transactions were processed in 2025; this is a 44.88% decline compared to the 9.63 million transactions processed in 2025. The low volume is as a result of the absence of payments from key government schemes such as the National Service Scheme (NSS). Transaction values increased by 25.10% from GhS 37.88 billion to GhS 47.39 billion in 2025. At the end of 2025, e-zwich had 2.89 million cards with value, signifying its importance as it continues to play a vital role for government schemes and rural banking services.

The interbank switching and processing system, gh-link recorded a decline in 2025 in both transaction volume and value. Transaction volumes decreased by 16.54% from 1.05 million transactions in 2024 to 875 thousand transactions in 2025. Transaction values also declined by 5.10%, from GhS 865.38 million to GhS 821.27 million. Although ATM transactions continue to decrease, POS transactions show a steady uptick, increasing by 77.30% in volume from 29.21 million transactions in 2024 to 104.07 million transactions in 2025. This trend is driven by increased merchant adoption and promotional activities at retail outlets such as Melcom and China Mall through the year.

Notably, the GIP platform recorded growth in 2025, with transaction volumes increasing by 25.85%, from 161.16 million transactions in 2024 to 202.82 million transactions in 2025. Transaction values showed growth in 2025, from GhS 355.07 billion in transactions processed in 2024 to GhS 711.96 billion in 2025, a growth rate of 100.52%. GhQR recorded growth during the period under review, with transaction volumes increasing by 3.48%, from 839 thousand transactions to 869 thousand transactions. Transaction values also grew by 80.56%, from GhS 7.16 billion to GhS 12.92 billion. The platform added 167 thousand new agents in 2025, bringing the total count of agents on the platform to 576 thousand. The growth realized by the platform is an indication of customer adoption of QR code payments in Ghana.

Mobile Money Interoperability (MMI) transaction volume increased by 37.80% from 210.68 million transactions to 290.31 million transactions. Transaction values grew by 69.67% from GhS 30.41 billion to GhS 51.60 billion. Transaction value outpaced transaction volume growth in 2025 due to the removal of the electronic levy(e-levy), which encouraged customers to conduct higher valued transactions on the platform without the burden of the levy. Wallet-to-Wallet transactions remain the dominant service on MMI, accounting for 282.95 million transactions valued at GhS 39.71 billion.

The Transaction volumes on GhanaPay Mobile Money platform increased from 1.48 million in 2024 to 11.95 million in 2025, while transaction value increased from GhS 567.75 million to GhS 5.28 billion in 2025. The Platform enrolled 635 thousand new clients, bringing the total number of clients enrolled to 1.45 million. The agent network also expanded to 15 thousand agents in 2025.

The 2025 performance demonstrates GhIPSS’s efforts to driving Ghana’s cashless agenda and promoting a digital economy. Looking ahead to 2026, GhIPSS will continue to focus on enhancing customer experience, ensuring system reliability and stability, and working with stakeholders to deepen adoption and usage, and promote financial inclusion across Ghana.

Source: Kareen Nelson(MIS)